Your Portfolio Management Software Isn't IP

Portfolio management software is a complicated, costly headache that most investors are ill-suited to build.

The finance industry guards its software tools as proprietary, especially in systematic / quantitative investing. This practice is archaic and counterproductive.

The evolution of open source software in other domains has democratized the creation of large-scale solutions, enabling even small teams to compete effectively. Despite these advancements in other sectors, financial software, particularly in portfolio management and backtesting, remains expensive, brittle, and inaccessible. This has not only stifled innovation, but also led to escalating costs as investors are forced to implement expensive, rigid solutions and hire bloated portfolio management teams.

It's time for change. It's time for portfolio management to embrace open source.

The Rising Tide of Costly Software

Every week, my junk email folder fills to the brim with companies pushing pricey software solutions. I'm tired of paying for things that ought to be free. I think we all are.

There is no end in sight to rising operating costs and shrinking margins; gone are the days of widespread 2&20 fee structures! Funds are increasingly burdened by expensive data requirements and software solutions, often packaged with unnecessary features or tied to restrictive vendor agreements. This trend towards monetizing what could be readily and freely available has placed a significant strain on resources, diverting attention and funds from core investment activities, namely: raising money and making money.

The Investor's Dilemma: Expertise Misaligned

Investors, renowned for their acumen in identifying market opportunities (alpha), find themselves increasingly entangled in the complexities of software development.

The skills required for effective investment are vastly different from those needed to create and maintain sophisticated portfolio management and backtesting software. This mismatch leads to inefficiencies, frustration, and a diversion of focus from their primary expertise.

Historically, investors have had to grapple with complex tasks like data transformation and analysis, financial forecasting, and managing computational infrastructure. Tools like pandas, scikit-learn, XGBoost, and cloud services have simplified some aspects, but a comprehensive, easy-to-use solution for portfolio construction and backtesting remains conspicuously absent.

This is perhaps because of the dated belief that all financial logic is IP. As misguided as it is, this belief remains pervasive in the industry (much to the dismay of Sergey Aleynikov in 2009). After all, finance is an industry notorious for resisting change.

Where Investors Have Fallen Behind

Further, because the skills required for effective investment are vastly different from those needed to create and maintain sophisticated software: investors suck at open source (no offense). While other industries have embraced open source with open arms, investors have struggled to do the same.

For example, in the application development world, DHH, the creator of Rails, shocked developers everywhere in 2005 when he famously demoed his open source web application framework that could build a blog from scratch in ~15 minutes. In the years that followed, many companies, including Shopify, GitHub, and Airbnb, were built on Rails, which empowered small teams to create substantial applications quickly (and led to the creation of many unicorn startups).

By adopting an open source model, projects are able to access the hive mind of their respective communities, resulting in something better than what could be built in isolation commercially.

While there have been glimmers of successful open source software projects in finance, they have been few and far between. A noteworthy (and rare) example is pandas, a library now synonymous with data analysis, which was initially created at AQR Capital Management.

Open Source Portfolio Management Software

Nevertheless, the world is finally ready for open source portfolio management software.

Advances including open source convex optimization engines and the widespread adoption of data engineering libraries laid the required groundwork. Some of these advances, in no particular order, are:

- Open source optimization engines: Tools like CVXPY have made commercial and open source engines (like OSQP) nearly interchangeable. While you may still pay for a commercial optimization engine (who doesn't like to go fast?), it's now possible to get started with an open source engine

- Open source data engineering libraries: pandas, Spark, and Dask have made organizing financial data at scale more manageable

- Comfort with open source: Years of reliable open-source solutions deployed in production have built trust

- Language adoption: Python has become the standard in the financial and data science sectors, which has made it easier for data scientists to collaborate on and improve industry standard tooling

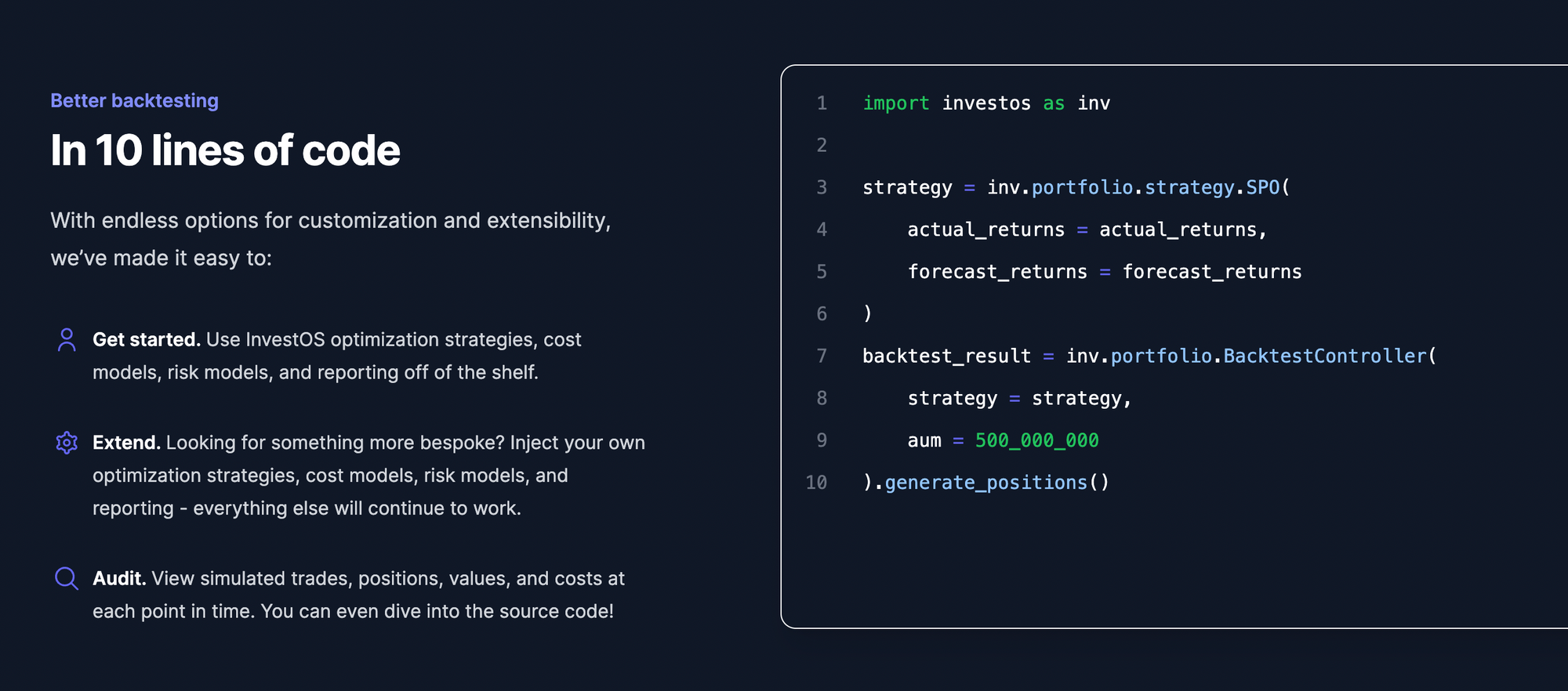

Investors excel at finding alpha, but they're bogged down by the intricacies of software development. InvestOS is our answer to this conundrum. It's more than just a tool; it's a liberator, freeing investors to focus on their core competency: uncovering and capitalizing on market opportunities.

It's time to shift the focus back to where it belongs: on investment acumen, not coding prowess.

InvestOS: Empowering Investors, Not Software Vendors

InvestOS isn't just another financial software solution; it's a statement against the status quo.

It's our love letter to active investors who want to spend time on what matters. Who want to stop recreating the wheel. Who want to stop writing big cheques to software vendors. It's a move to standardize and democratize access to high-quality portfolio management tools, allowing investors to focus on what truly constitutes their competitive edge: their investment strategies, not their software.

We want to help you create, improve, understand, and test substantial investment strategies quickly, easily, and for free. By providing a robust, open-source solution, we're giving power back to investors, enabling them to focus on their true strength: finding and leveraging alpha.

After all, your portfolio management software shouldn't be your IP.

Explore our guides or get in touch at hi@investos.io. We invite you to collaborate with us to improve the future of investment software!